Understanding Your Investment Performance

There are different ways to measure returns for assets. Understand which method is being used when reviewing your investment performance.

Your Rate of Return

Reviewing Your Returns

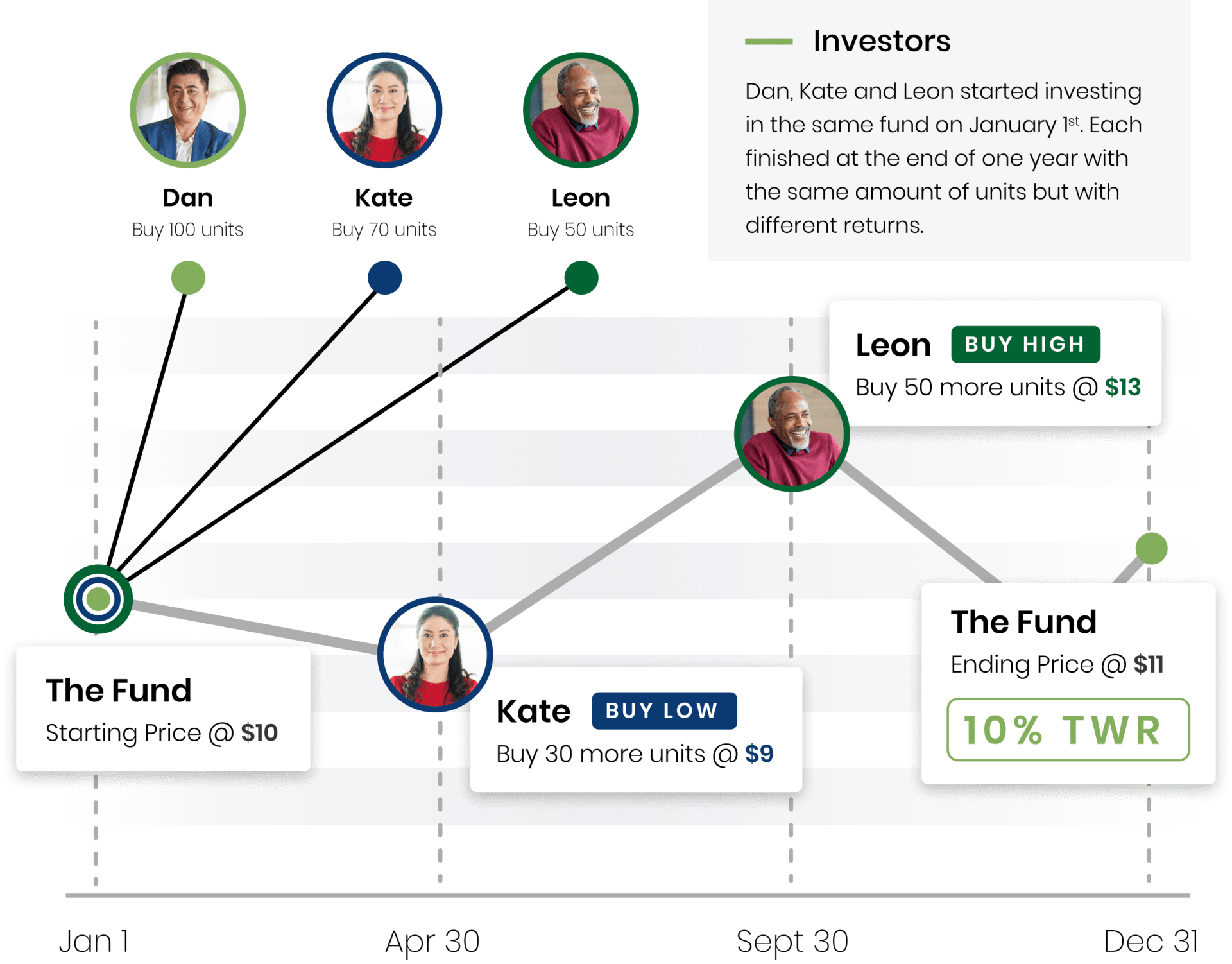

There are a number of ways to calculate an investment rate of return. Time-Weighted and Money-Weighted are two calculation methods that investors see when looking at their asset performance.

Time-Weighted Return (TWR)

The Annual Performance Report that you will receive for the period ending December 31, 2021 will reflect returns calculated using the money-weighted calculation method.

The Impact of Investor Behaviour

Investor behaviour can have a significant impact on

Money-Weighted Returns

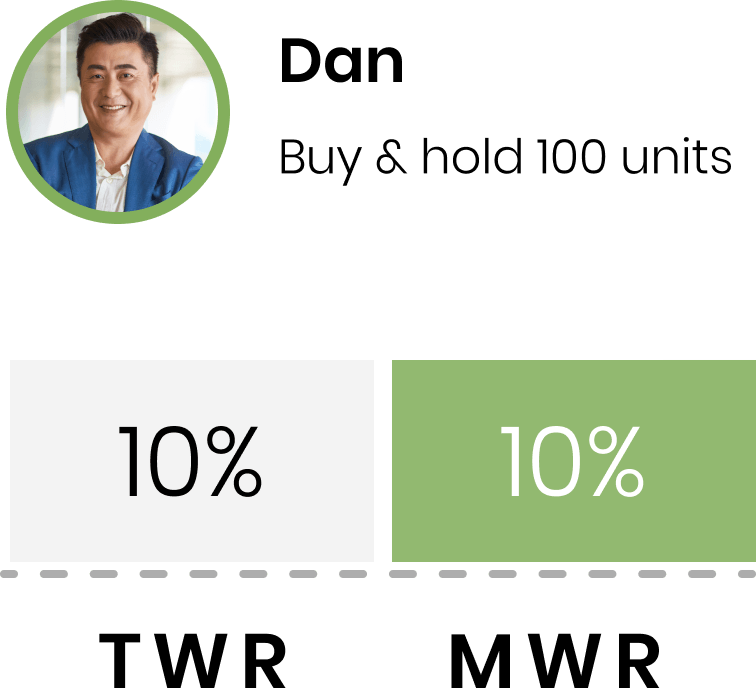

Dan’s buy and hold strategy yielded him the same results as the fund. Cash flows are not a consideration, so the MWR and the TWR are the same.

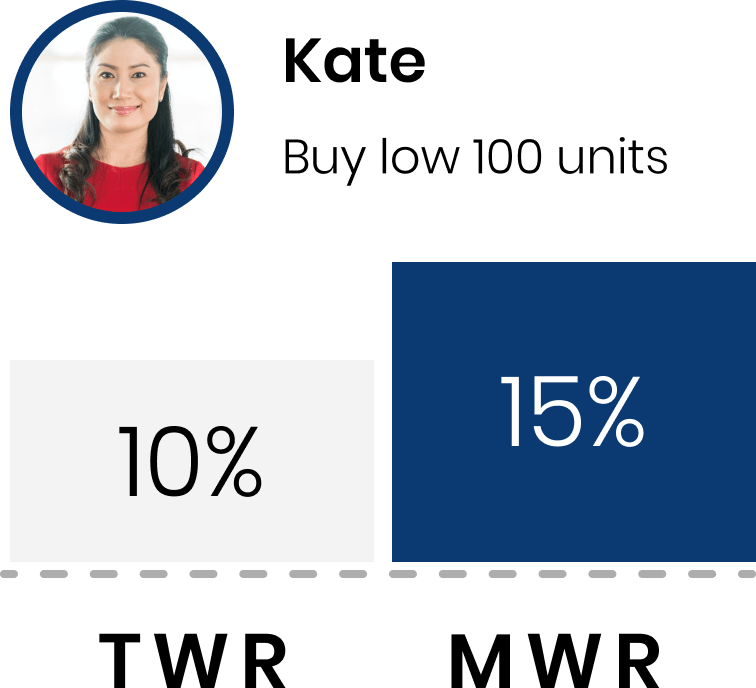

Kate bought additional units of the fund while it was underperforming, resulting in her MWR being higher.

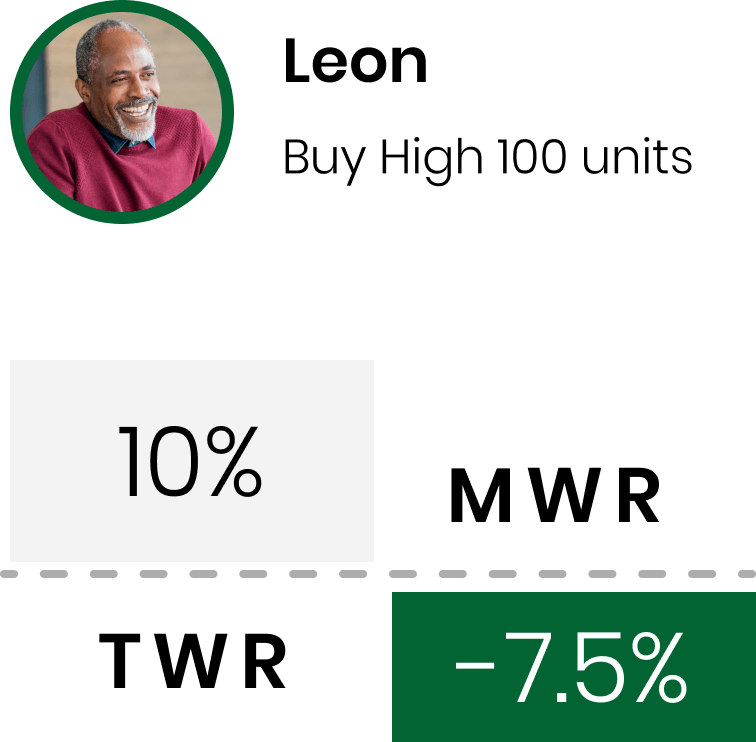

The timing and size of investments makes a difference

Each investor finished with the same amount of units of The Fund. Although their Time-Weighted Returns are the same, their Money-Weighted Returns (or Personal Rate of Returns) are very different.

We can help you understand how your personal rate of returns can influence the outcomes of your long-term investment goals.

Contact Us

Trademarks owned by Investment Planning Counsel Inc. and licensed to its subsidiary corporations. Investment Planning Counsel is a fully integrated Wealth Management Company. Mutual Funds available through IPC Investment Corporation and IPC Securities Corporation. Securities available through IPC Securities Corporation, a member of the Canadian Investor Protection Fund. Insurance products available through IPC Estate Services Inc. & PPI Management Inc.

© Copyright 2022. Ativa Interactive. All Rights Reserved.