UPDATED SECTION:

CERB EXTENTED BY 8 WEEKS

FOR INDIVIDUALS AND FAMILIES

Canada Emergency Response Benefit (CERB)

For Canadians who have lost income due to COVID-19.

Individuals can still earn up to $1000/month while collecting CERB.

Available to:

- Those who don't have access to EI

- Those who have run out of EI as of January 1, 2020

(includes seasonal workers)

UP TO

$2,000 EVERY 4 WEEKS FOR 24 WEEKS

WHO CAN APPLY:

- Those who have lost jobs due to COVID-19.

- Parents who must stay home without pay to care for kids who are sick or because of school and daycare closures.

- Wage earners, self-employed or contract workers who are not eligible for Employment Insurance.

HOW TO APPLY:

The CERB Application Portal is now open.

Click here

for more information.

Visit CRA My Account

and sign up for direct deposit.

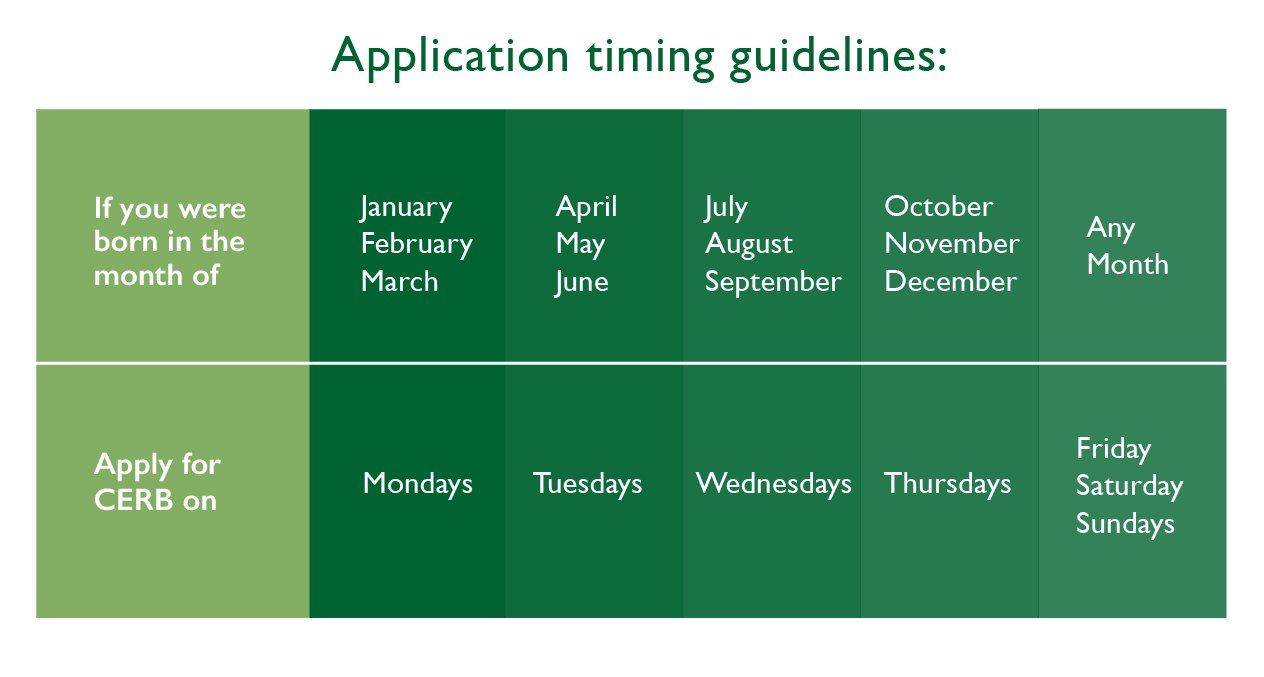

Application dates will not affect timelines for your receipt of payments.

NOTE:

If you are receiving a wage subsidy as part of the government's measures for businesses, you will not qualify for CERB. If you've already applied for EI, you do not need to re-apply for CERB.

STUDENT BENEFITS

CANADA EMERGENCY STUDENT BENEFIT (CESB):

- $1,250 per month for eligible students, or $2,000 per month for eligible students with dependents or disabilities. Benefit available between May and August 2020.

CERB: (CANNOT BE COMBINED WITH CESB)

- Students who are employed but are making less than $1,000/month can apply for CERB.

STUDENT LOANS:

- Six-month interest-free moratorium on repayment of Canada Student Loans, effective March 30. Interest will not accrue during this time.

CANADA SERVICE STUDENT GRANT (CSSG):

- For students who choose to do national service and serve their community, the new CSSG will provide up to $5,000 for their education in the fall.

HOW TO APPLY:

The application portal will open on May 15. Click Here

for more information.

CANADA CHILD BENEFIT (CCB)

Maximum annual benefit will be increased by $300 per child for the 2019-20 benefit year. Overall increase will be approximately $550 per family.

Will be paid out as part of scheduled payments in May.

HOW TO APPLY:

Those who already receive this benefit do not need to re-apply.

For new CCB applications, click here.

SENIORS BENEFITS

A one-time, tax-free payment is available to the following:

- $300 for seniors eligible for the Old Age Security (OAS) pension

- $200 for seniors eligible for the Guaranteed Income Supplement (GIS)

Anyone who receives both the OAS pension and the GIS will be eligible for both payments for a total one-time payment of $500.

HOW TO APPLY:

The payments will be applied automatically – no application necessary.

RRIF WITHDRAWALS

Minimum withdrawal amount will be reduced by 25% for 2020. Contact your advisor or fund company.

TAX RETURNS

Filing deadline moved to June 1, 2020 from April 30, 2020. Payment of income tax can be deferred to August 31, 2020.

NOTE:

If you expect to receive GST credit or the Canada Child Benefit, do not delay your 2019 tax filing.This will help ensure entitlements are properly determined.

GST CREDIT

Maximum annual GST credit will be doubled for the 2019-20 benefit year. This will increase income by $400 for qualifying individuals and $600 for couples.

One-time special payment to be made by early May 2020.

HOW TO APPLY:

No action required.This will be paid automatically to those who qualify.

Sources:

This report is provided for informational purposes only and should not be construed as specific legal, lending, or tax advice. Individual

circumstances and current events are critical to sound planning; anyone wishing to act on the information in this report should consult with his or her investment advisor and tax specialist.The information and any statistical data contained herein were obtained from sources that we believe to be reliable and accurate at the time of publishing. IPC is not liable for any errors or omissions.

Trademarks owned by Investment Planning Counsel Inc. and licensed to its subsidiary corporations. Investment Planning Counsel is a fully integratedWealth Management Company. Mutual Funds available through IPC Investment Corporation and IPC Securities Corporation. Securities available through IPC Securities Corporation, a member of the Canadian Investor Protection Fund. Insurance products available through IPC Estate Services Inc. & PPI Solutions.